As wind turbines grow larger, so do risks in tornado-prone areas

March 18, 2024

Ørsted proposes 1.1-GW Starboard Wind offshore project for Connecticut

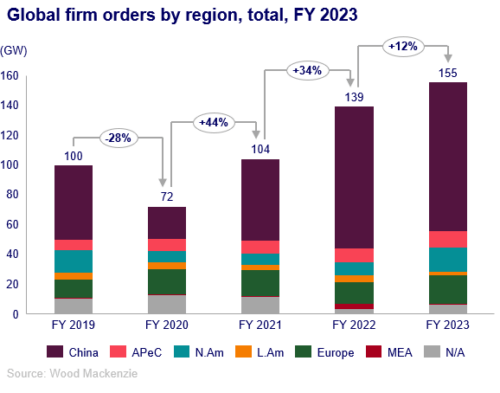

March 27, 2024Global wind turbine order intake hit new highs in 2023 with 155 GW procured for the year, an increase of 16 GW from 2022. As both China and Western markets broke records for order intake, annual investment reached an estimated $83 billion, according to Wood Mackenzie’s “Global wind turbine order analysis: Q1 2024” report.

In Q4 of 2023, global order intake increased 2.5% and 12% year-over-year (YoY) for the full year, stated the report.

Developers in China ordered approximately 100 GW in 2023, the largest annual order intake on record and marks consecutive years of at least 90 GW of order intake in the country. Onshore demand from China’s wind bases has driven most of this growth.

Developers in China ordered approximately 100 GW in 2023, the largest annual order intake on record and marks consecutive years of at least 90 GW of order intake in the country. Onshore demand from China’s wind bases has driven most of this growth.

Western markets contributed with record order intake levels in 2023, adding a record-breaking 55 GW in 2023, highlighted by YoY momentum in Europe (19 GW) and North America (17 GW).

“A record haul outside of China in Q4 and a near doubling of order capacity in North America throughout 2023 helped continue market recovery for Western markets, with a 26% increase in order intake YoY,” said Luke Lewandowski, Vice President, Global Renewables Research at Wood Mackenzie.

Global intake for offshore wind decreased by 61% in Q4 of 2023, a 3.1 GW drop YoY, and 7.2% overall, a fall of 1.5 GW YoY. This decrease was counterbalanced by an increase in global onshore wind orders, up 4.2 GW (+11%) in Q4 YoY and 17.7 GW (+15%) for the full year.

“Despite high-profile offtake cancellations and industry headwinds for offshore wind, firm order intake for the offshore sector tripled for markets outside China in 2023. A 56% drop in orders from China due to a pause in procurement decisions resulted in a modest drop globally from the record set in 2022. In total, developers globally ordered 19 GW of offshore wind turbine capacity in 2023,” added Lewandowski.

Envision led the way with 22 GW of order intake in FY 2023, followed by Vestas (19 GW), and Goldwind (18 GW). Vestas led all OEMs in Q4 for the second quarter in a row with 8 GW, powered by 5 GW in the United States.

According to the report, demand for onshore models rated 7 to 9.9 MW exploded in 2023, seeing a sevenfold increase YoY.

News item from WoodMac

Filed Under: News